Factoring is the business of acquisition of receivables of assignor by accepting assignment of such receivables or financing, whether by way of making loans or advances or in any other manner against the security interest over any receivables. Factoring can be both, with recourse and without recourse to the exporter. Globally, without recourse factoring is more prevalent for international trade, whilst both forms exist for domestic trade.

Factoring is a service covering the financing and collection of accounts receivable in domestic and international trade. It involves an agreement between a Seller and a Factor wherein the seller agrees to assign its open account receivables which are on credit terms to the Factor who in turn agrees to perform at least two of the following services:

- Financing by way of pre-payments against invoices

- Sales ledger Maintenance

- Collection of Account Receivables

- Credit protection against default in payment by the Buyer

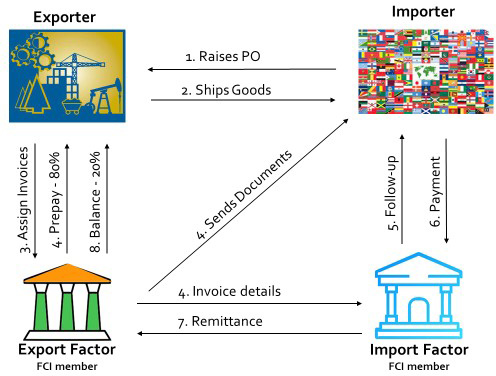

Given below is the process flow for Export Factoring under Two Factor system*:

The benefits of international factoring for exporters include:

- Working capital improvement

- Access financing at better conditions, benefitting from the creditworthiness of the buyer

- Reducing time-consuming credit administration and associated costs

- Reducing risks, while offering foreign customers competitive open account terms

- Expanding turnover by offering flexible payment terms

- Strengthening of revenues by improving efficiency in collection of payments

- 100% credit protection against bad debts and customer insolvency

- Better borrowing potential and an opportunity to make use of supplier discounts